If you are looking to save tax and keep you money invested for at least 3 years, ELSS mutual funds are the best tax-saving investment tool. ELSS mutual funds comes with dual benefit of tax-saving and wealth building. Like other equity mutual funds, ELSS mutual funds invest your money into stock market to yield high returns. Most ELSS funds have a diversified portfolio of large cap, mid cap and small cap stocks.

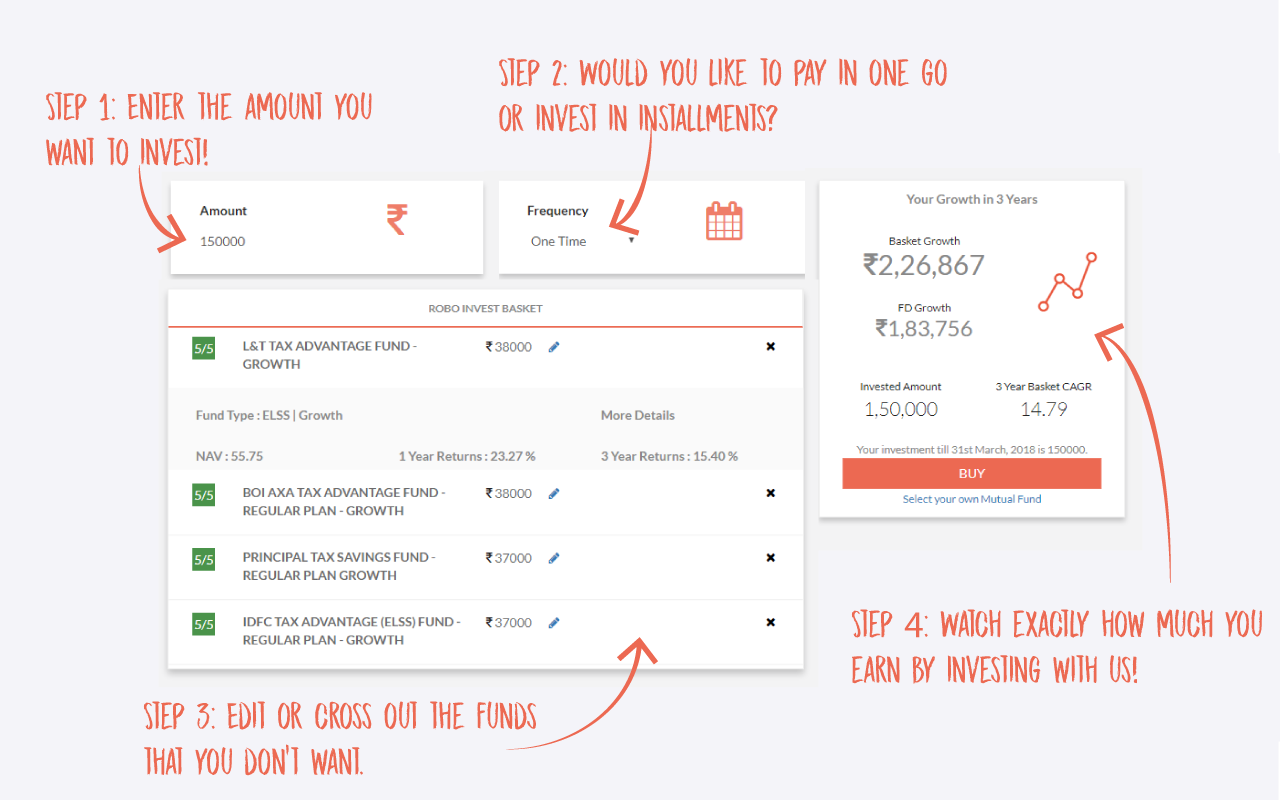

You can invest upto Rs. 1,50,000 and save upto Rs. 45000 of taxes every year under section 80C of Indian Income Tax Act. Also, the capital gains from ELSS funds are completely tax-free. ELSS funds have a lock-in period of 3 years which is lesser than all other tax-saving investment options.